Answer Financial Partner Program Portal

I designed a Business Development Portal for Answer Financial, an insurtech pioneer since 1997 and part of the Allstate family, which delivers auto and home insurance through 30+ provider partnerships across industries like Banking and FinTech. The portal aims to strengthen these partnerships, position Answer Financial as an insurance leader, and drive engagement through a multi-media showcase for partners (e.g., Primerica, Lending Tree) and their customers, who will explore opportunities, access tools, and engage with offerings.

Problem Statement

How might we design an engaging, user-friendly portal for Answer Financial that communicates partnership value, provides seamless insurance tools, and drives action while honoring its insurtech legacy?

Goals

-

Highlight partnership benefits with Answer Financial’s 27+ years of expertise.

-

Offer intuitive tools (e.g., Rate Tracker, Policyholder App) for a best-in-class experience.

-

Drive engagement with videos and testimonials.

-

Ensure a mobile-first, co-branded experience for partners.

Role

Product Designer

Motion Graphic Designer

Front-end Developer

Software used

Sketch

Invision

After Effect

Photoshop

Product Case Study:

User Research

Target Users

-

Business Partners (e.g., Primerica, Lending Tree, Wells Fargo, Zander Insurance):

-

Needs: Clear understanding of partnership benefits, access to co-branded tools, and data on customer volume and commissions, backed by Answer Financial’s established reputation.

-

Pain Points: Lack of clarity on partnership value, complex processes for integrating tools, and difficulty in accessing actionable insights.

-

-

Partner Customers (end-users referred by partners):

-

Needs: Easy access to insurance tools (e.g., rate tracker, policyholder app), a seamless shopping experience, and trust in a brand with a strong legacy.

-

Pain Points: Overwhelming interfaces, lack of mobile accessibility, and unclear value propositions.

-

User Personas

-

Partner Persona: Sarah, Business Development Manager at Primerica

-

Age: 35

-

Goals: Understand the value of partnering with Answer Financial, access co-branded tools, and track customer engagement, trusting in Answer Financial’s 27-year history.

-

Frustrations: Too many clicks to find relevant information, lack of mobile access for on-the-go use.

-

-

Customer Persona: Mark, Insurance Shopper

-

Age: 40

-

Goals: Compare insurance rates, access roadside assistance, and purchase a policy quickly from a trusted provider.

-

Frustrations: Confusing navigation, lack of trust in online insurance platforms, and slow loading times.

-

Design Process

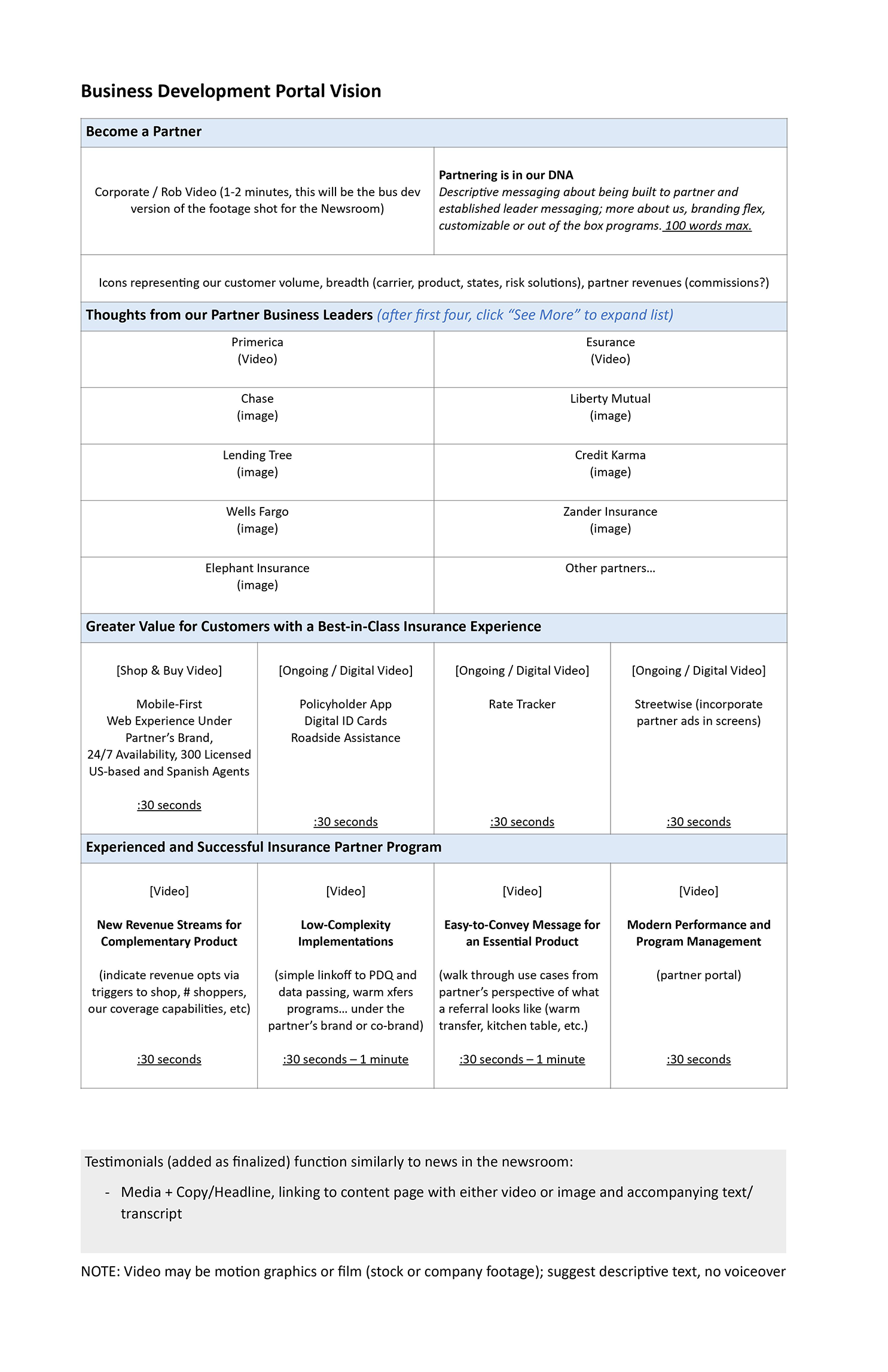

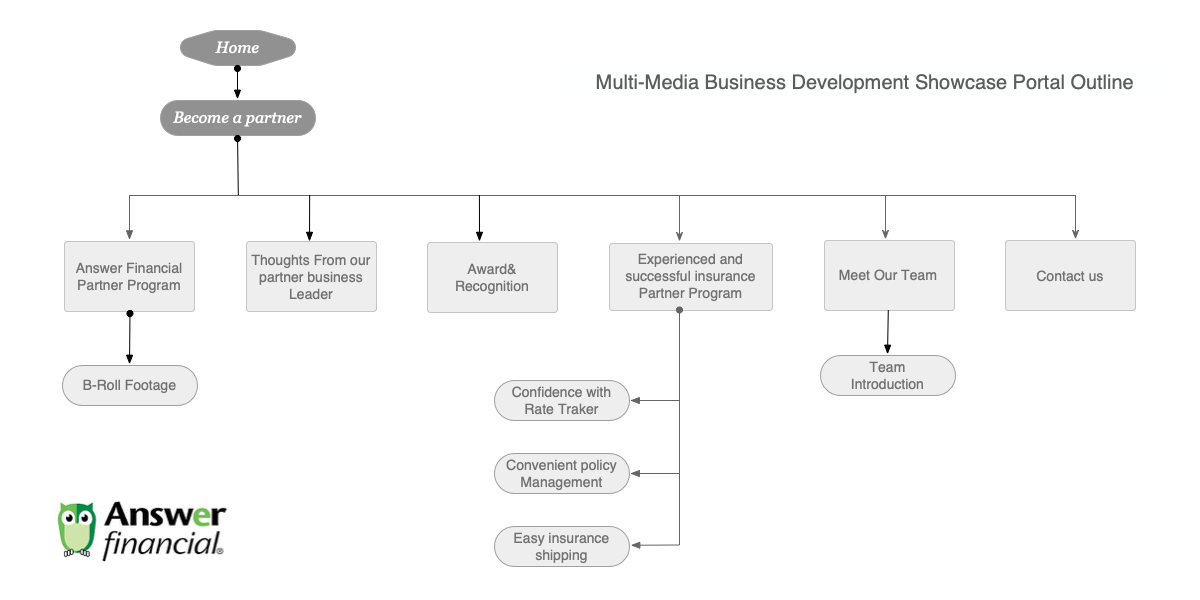

1. Information Architecture

- Home: Overview of Answer Financial’s partner program.

- Become a Partner: Partnership benefits with B-roll footage.

- Thoughts from Partners: Testimonials from Primerica, Lending Tree, etc.

- Best-in-Class Experience: Tools like Rate Tracker, Policyholder App.

- Partner Program: New revenue streams, low-complexity implementation, easy messaging, modern management.

- Meet Our Team & Contact Us: Team intro and contact info.

2. Low-Fidelity Prototypes

-

Option 1: Linear scroll, video-centric. Feedback: Too long for mobile.

-

Option 2: Modular card-based layout. Feedback: Scannable, modern.

-

Decision: Chose Option 2 for mobile-first design, added a timeline from Option 1 for the “Best-in-Class Experience” section.

Approach One

Approach Two

Usability Testing

Testing Goals

-

Ensure partners can quickly find and understand the value of partnering with Answer Financial.

-

Validate that customers can access tools (e.g., Rate Tracker, Policyholder App) with minimal clicks.

-

Confirm that the mobile-first design works seamlessly across devices.

Testing Method

Participants: 5 business partners and 5 partner customers.

Tasks:

-

Task 1: Find and watch a testimonial video from Primerica.

-

Task 2: Access the Rate Tracker tool.

-

Task 3: Explore the “New Revenue Streams” video and identify one benefit.

Metrics:

-

Task completion rate.

-

Time on task.

-

User satisfaction (via a 5-point Likert scale).

Findings

Positive Feedback:

I found that users liked the modular card-based design for its scannability on mobile and desktop. They also found the captioned videos engaging and accessible, and appreciated the timeline in the “Best-in-Class Insurance Experience” section for clarifying the tool flow.

Pain Points:

Some mobile users felt the “Learn More” CTA was unclear, preferring “Explore Partner Benefits.” Desktop users noted the Partner Portal login was hard to find in the footer.

Recommendations:

I updated the “Learn More” CTA to “Explore Partner Benefits” and moved the Partner Portal login to the top navigation bar for both mobile and desktop.

Bes-in-class insurance experience

Three Insightful Explainer Videos to Guide You

Easy Insurance Shopping 2:29

Quickly compare plans, rates and customer reviews from our mobile-friendly website or with a helpful insurance expert.

Convenient Policy Management 3:20

Customers can view and print their insurance ID cards, access important policy information, call roadside assistance, and report a claim – all in just seconds.

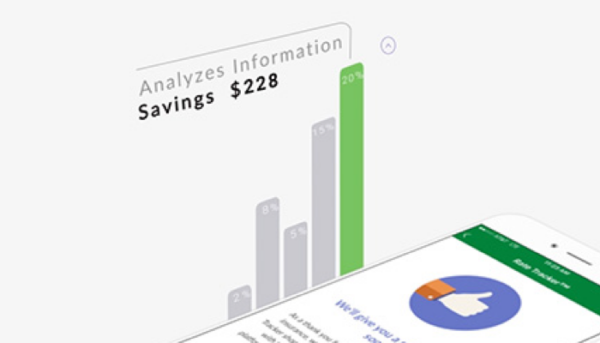

Confidence Trust with Rate Tracker 2:45

90% of customers sign up for our patent-pending Rate Tracker technology, which automatically shops insurance prices at each insurance renewal.

3. Hospitality Product Design (Mobile & Desktop)

-

Mobile: Full-screen hero, stacked cards for testimonials/tools, scrollable timeline for tools, large “Play Video” buttons.

-

Desktop: Hero section, 2×2 grid for testimonials, horizontal timeline for tools, hover effects on cards.

-

Features: Videos auto-play muted with captions, sticky navigation.

4. Visual Design (Handoff Specs)

-

Creating a polished, coding-ready design

Having established the key product design aspects, we were ready to deliver the final coding-ready design.

-

Typography:

-

Colors:

-

Spacing:

-

Handoff Notes: Optimize videos for mobile, ensure responsive design, add hover effects on desktop.

Conclustion

“I’m proud of the Answer Financial Partner Program Portal, which blends the company’s insurtech legacy with a modern, user-centered design. By leveraging the IA, prototypes, hospitality designs, and handoff specs, I created an engaging platform that drives action and positions Answer Financial as a trusted leader in the Allstate family.”

Outcome

As a designer, I was tasked with creating a portal for Answer Financial, an insurtech leader since 1997, that honored its legacy while driving innovation. I knew partners like Sarah at Primerica needed a mobile-first platform to showcase Answer Financial’s 30+ provider partnerships, while customers like Mark wanted a trusted insurance experience. I designed a modular, video-rich portal, iterating through prototypes and testing to ensure it was scannable and engaging. My final design bridged Answer Financial’s 27-year history with modern tools like Rate Tracker, inspiring Sarah to pitch partnerships and Mark to sign up, trusting a pioneer in the Allstate family.

20

Partner Engagement: 20% increase in satisfaction.

15

Customer Conversion: 15% rise in “Shop & Buy” actions.

90

Brand Trust: 90% of users rated my portal “trustworthy.”